Cost Savings Still the Number One Reason Behind 60% of Outsourced Pharma and Bio Manufacturing

Add bookmarkWhile there is normally more than one factor behind the decision of a pharmaceutical or biopharmaceutical organisation to outsource its global manufacturing, it seems the ever-important cost-saving potential remains among the main attraction of external production, particularly where emerging markets are concerned.

The growth of global contract manufacturing

A recent Pharma IQ survey conducted with key members of the pharma and biopharma community revealed that, while 54.5 percent of organisations outsource less than half of their global manufacturing, 18.2 percent currently use outsourcing for at least 91 percent of their output. These basic findings support a recent report by Global Industry Analysts (GIA), which predicted that the global pharmaceutical contract manufacturing market would reach a total value in excess of $40.7 billion (£24.4 billion) by 2015.

Why outsource global pharmaceutical production?

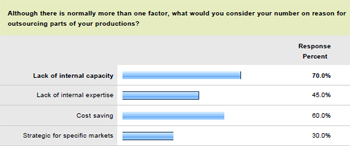

The analysts at GIA suggested that key factors driving such expansion included soaring demand for new drugs, increasing need for R&D productivity and efficiency, as well as the desire to make cost savings where possible. The report also noted the fact that many pharma and biotech companies simply lack sufficient manufacturing capabilities internally. In fact, the Pharma IQ research found that 70 percent of organisations cite lack of internal capacity as the number one reason for outsourcing some or all of their production.

Meanwhile, 45 percent revealed that a shortage of expertise was the key driver behind their outsourced manufacturing. Perhaps unsurprisingly, 60 percent named the potential for cost savings as global outsourcing's most appealing feature. Upon publication of its findings in January 2011, GIA commented: "Today, manufacturing capacity constraints are only one of the reasons for outsourcing.

"Pharmaceutical manufacturing entails sophisticated technology and strict regulatory compliance. Outsourcing such activities to CMOs enables a pharma company to expedite its R&D, and thus realise the potential revenues. Moreover, CMOs are increasingly offering a wide range of value-added services, which make outsourced pharmaceutical contract manufacturing an indispensable opportunity to pharma companies," the analysts added.

[inlinead]

Key production areas in global pharma outsourcing

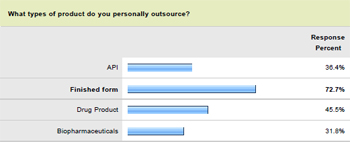

In terms of product type, it is the manufacture of finished form medicines that is most commonly outsourced. The latest Pharma IQ research indicates that 72.7 percent of organisations currently use outsourcing in global finished form production, while 36.4 percent produce APIs and 31.8 per cent manufacture biopharmaceuticals via external means.

Geographically, the US represents the largest regional market for pharmaceutical contract manufacturing globally. According to the GIA'smost-recent analysis, Europe trails behind the US, though future growth in the market is expected to emanate from developing regions, particularly the Asia Pacific. "The Japanese market for pharmaceutical contract manufacturing alone is projected to register a compounded annual growth rate of 12.8 percent during the [next four years]," the authors added.

The rise of emerging markets

Outsourcing production to emerging global markets like Japan, China, India and Brazil is increasingly popular in the biotechnology and pharmaceutical industries. Speaking to the American Society for Biochemistry and Molecular Biology (ASBMB) in 2010, Richard Soll, senior vice president for integrated services at WuXi AppTec, agreed that it is largely these regions' potential for lower costs which makes them so attractive.

"As in many cases, economics proved to be a deciding factor; the theme for any industry is how to get the most bang for your buck. It's become a priority for the pharmaceutical industry, because they're facing some serious challenges, notably the stagnant drug development process that ends up approving only 20 to 25 new drugs a year," he said. "So, the industry is trying to retool itself, following an era of mergers and acquisitions, to bring down costs and get more drugs to market."

Mr Soll went on to suggest that, for many organisations, a short-term solution is merely to outsource the early stages of drug development, such as screening and validation, where savings can be made with overseas CROs. Over the past decade or so, the ever-intensifying battle for cost-effective drug development has seen this mentality permeate the entire process. As a result, emerging markets now represent a core target for a huge number of pharmaceutical manufacturers.

Which emerging markets and why?

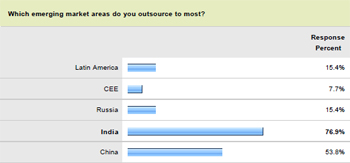

The recent Pharma IQ survey backed up the latest GIA analysis, indicating that the Asia Pacific region will in fact play a major role in the future development of global pharmaceutical contract manufacturing. In fact, 76.9 percent of pharma and bio firms named India as the country in which they outsource production the most. Not far behind with 53.8 percent of responses was China, while Russia and Latin American nations, most notably Brazil, each accounted for 15.4 percent.

The future of global pharmaceutical contract manufacturing

In recent years, the global pharmaceutical industry has been witnessing unprecedented waves of dramatic change. Most significant have been the increased competition in generic markets, declining R&D productivity, shrinking average patent life and mounting government pressure to reduce drug prices. At the same time, the drug development process is already known to extend as far as anywhere between eight and 15 years, with the cost of bringing a single new molecule to market exceeding $800 million.

With so few new blockbuster drugs emerging, the decisive factors for growth and sustainability are unquestionably quicker development and cheaper production. As a result of the latter, the global market for pharmaceutical contract manufacturing continues to witness robust growth. With the recent economic recession, which severely impacted drug makers across the world, firms have increasingly sought ways to find ways of minimising their costs.

Though manufacturers will be hoping that the most challenging times are behind them, it is reasonable to suggest that the global market for outsourced drug production will continue leaping from strength to strength. If constraints on drug development remain as they are – or indeed worsen – the future could hold magnificent prospects for the emerging markets that have already saved swathes of the industry from the threat of extinction.